Though some financial market participants may feel as if the pressures of implementing the initial margin (IM) rules are behind them, a closer look in the rear review mirror reveals that the challenges remain very close at hand.

Since the implementation of the last phase of IM on September 1, 2022, IM has become a part of the business-as-usual (BAU) infrastructure of every firm that trades over-the-counter uncleared derivatives (OTC Derivatives). Although tools such as threshold monitoring helped curb the number of counterparties that needed to be re-papered by the last regulatory deadline, some market participants are finding that their BAU IM workstreams are increasing for various reasons. New counterparties coming into the in-scope fold increasingly require IM documentation. Some firms must now repaper legacy Credit Support Annexes (CSA) for counterparties that have exceeded internal threshold limits to avoid breaching the $/€50 million regulatory threshold (IM Threshold Limit). Other firms have been compelled to negotiate IM documentation to have the flexibility to enter large trades that could potentially breach the IM Threshold Limit.

Many CSAs put into place during prior IM phases require amendments to update applicable regimes, reallocate IM thresholds, amend minimum transfer amounts, revisit products subject to SIMM and Grid, change the margin approach, select additional access events, and modify collateral access rights.

In short, though the regulatory deadlines of IM are past us, IM continues to consume BAU workstreams in the financial services industry and respite from the challenges has been limited.

The Strain on In-House Counsel (“IHC”) Teams

The depth and breadth of the IM challenges facing many IHC Teams tends to be remarkably consistent. Limited bandwidth due to staff reductions and increased workloads appears to be the main culprit standing in the way of IHC Teams integrating IM into their BAU work streams. The challenges of navigating through the contractual framework of IM agreements and negotiating their complex provisions can be quite taxing and time-consuming. There is a wide array of documents that must be negotiated for each party’s IM posting leg obligation, depending on the type of custodian each party uses to segregate its IM (i.e., triparty custodian or third-party custodian), which ultimately results in the parties executing between 5-7 agreements per negotiation.

Some IHC Teams are still working on repapering tail-end participants from IM Phase 6, while others continue to update their trading policies and compliance procedures. Some have not had the resources to upskill their negotiators to understand the complexity of IM and the legal documentation architecture, while there are others that may still be working on updating their IM templates, devising commercial fallbacks, and maintaining legal opinions up to date. While the prior pressures of operating in a regulatory-phased project environment may have ostensibly eased, the reality is that that they have just transitioned to BAU workstreams where they increasingly must be addressed.

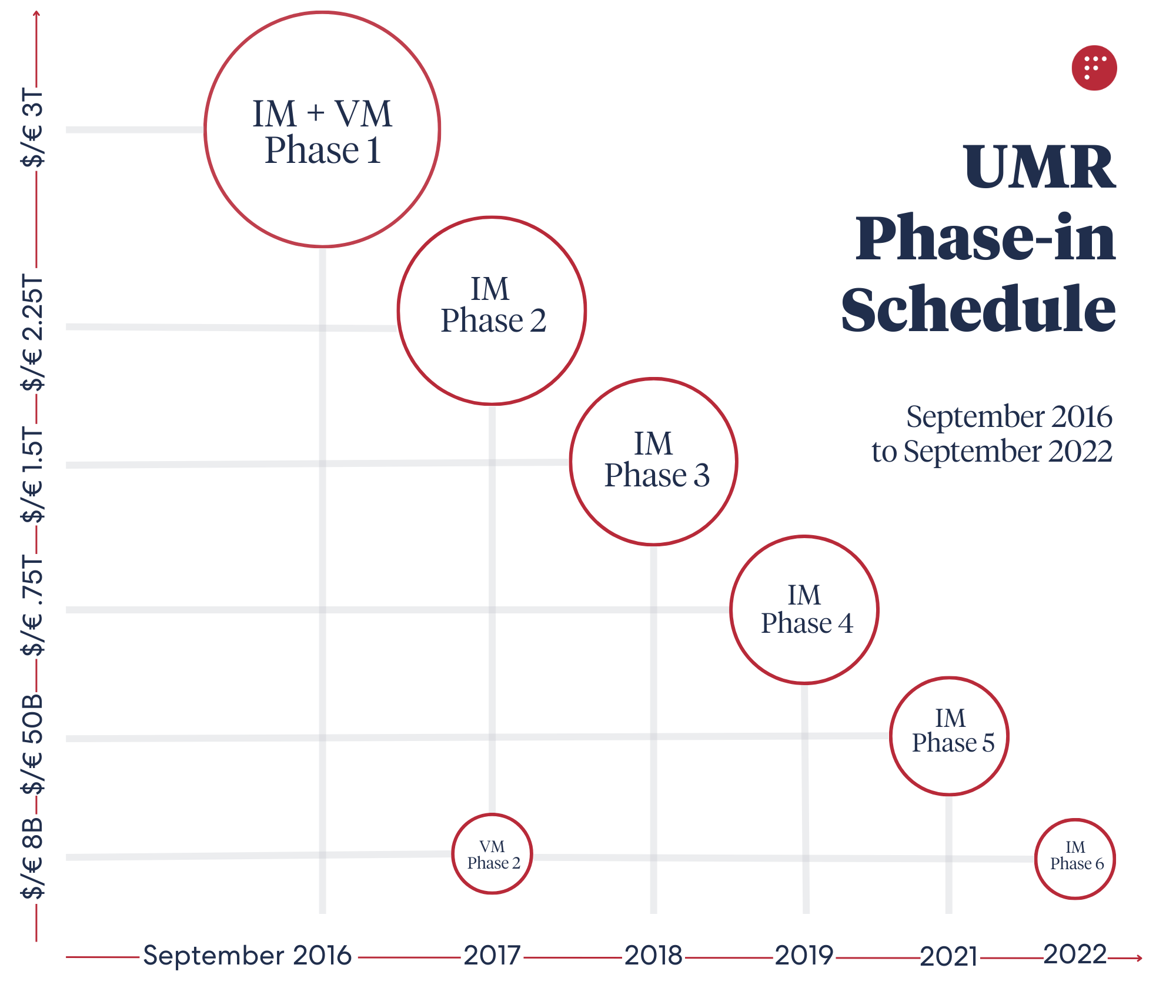

Revisiting How We Got Here

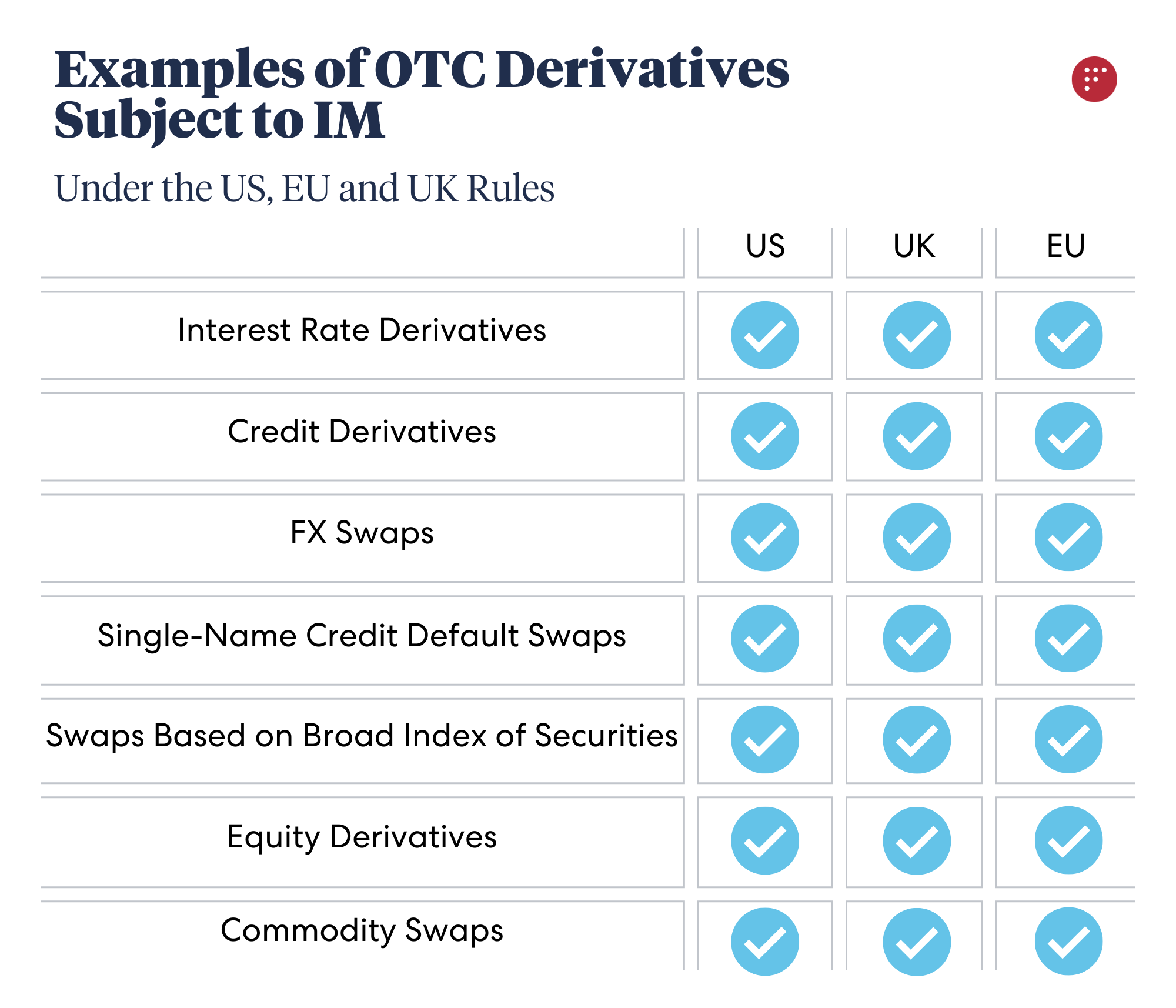

After the global financial crisis of 2008 (“Financial Crisis”), the nation members of the Group of 20 instructed the International Organization of Securities Commissions (“IOSCO”) and the Basel Committee on Banking Supervision (“BCBS”) to develop an international framework to reduce systemic risk associated with OTC Derivatives. IOSCO and BCBS’s proposed framework included a requirement that systemically important entities bilaterally exchange IM and variation margin (“VM”; and together with IM, “UMR”) to diminish the types of counterparty risk that triggered the Financial Crisis. VM was instituted to protect parties from mark-to-market losses in respect of OTC Derivatives, while IM was established to provide a buffer against losses associated with the change in the value of an OTC Derivative between a close-out period following an event of default and the last bilateral exchange of VM. UMR was ultimately adopted by a number of countries, including the United States (“US”), the European Union (“EU”), the United Kingdom, Canada, Switzerland, Korea, Hong Kong, and Singapore, and phased-in between September 1, 2016 and September 1, 2022. Per the International Swaps and Derivatives Association, the amount of VM and IM collected by entities that trade OTC Derivatives totaled $1.4 trillion at the end of 2022, divvied up between $1.1 trillion of VM and $325.7 billion of IM.[1]

Refresh of the UMR Implementation Schedule

The UMR requirements are based on the aggregate average notional amount (AANA) of OTC Derivatives traded by an entity and its applicable regulatory regime(s). The analysis must be done on a consolidated group level and is calculated differently based on the jurisdiction of the entity. For example, under the EU rules, AANA is calculated by summing the notional amounts of all OTC Derivatives for the last business day in March, April, and May of the current year, and then dividing that sum by 3.[1] On the other hand, the calculation of AANA is a bit more nuanced under the US rules, depending on whether the entity is subject to the Commodity Futures Trade Commission (CFTC) or the US Prudential Regulators (PRU). AANA, under the rules of the CFTC, is calculated in the same fashion as it is under the EU rules.[2] However, under the PRU rules, AANA is calculated by summing the notional amounts of all non-cleared swaps, non-cleared security-based swaps, foreign exchange (FX) forwards, and FX exchange swaps for each business day in June, July, and August, and then dividing the quantum by 3.[1]

With IM Phase 6 now behind us and UMR integrated into BAU workstreams, any entity whose AANA exceeds the $/€ 8 billion threshold must comply with UMR.

Get in touch to learn how Factor can support you with the ever-present challenges of initial margin.

Disclaimer

Please note that this summary is for general information purposes only. It does not constitute legal, accounting, or tax advice and may not be relied upon for any such purpose. The summary is not intended to be comprehensive, and Factor does not assume responsibility for updating any of the information herein based on any future regulatory changes to the UMR rules.